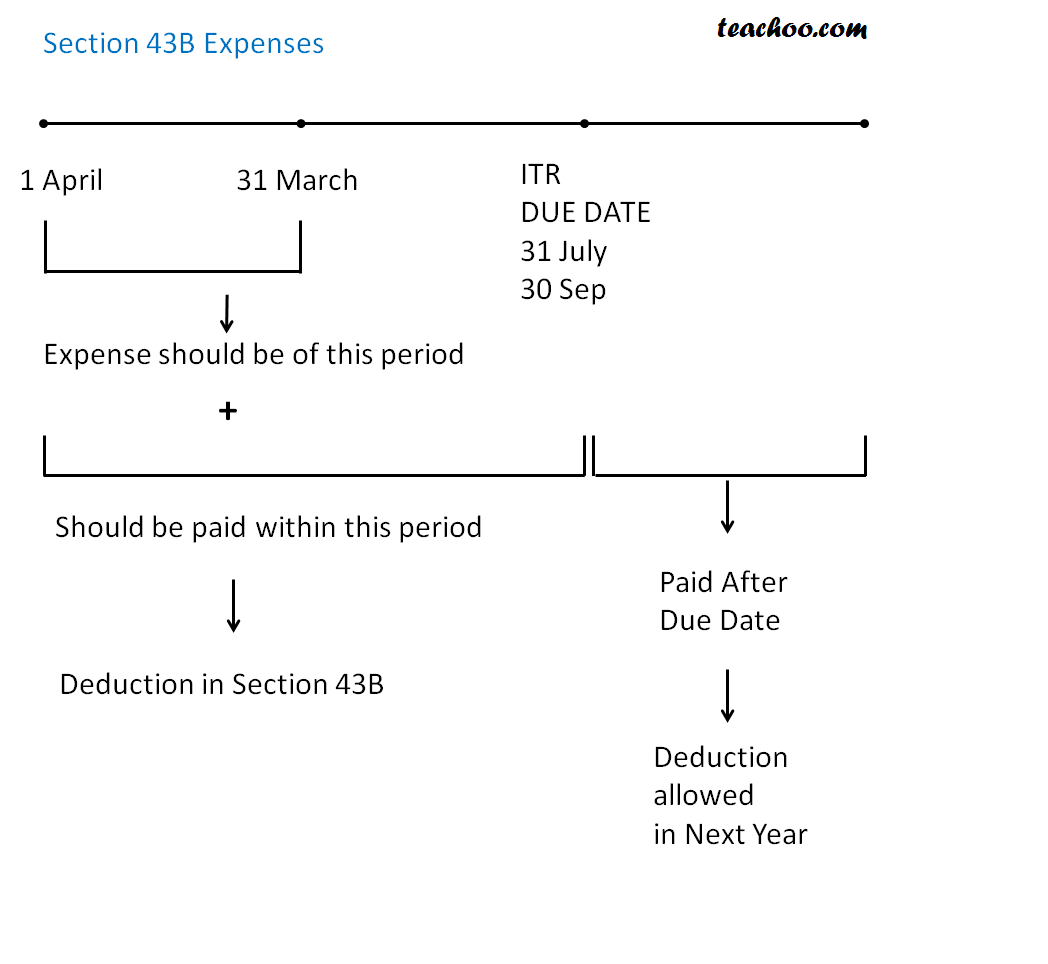

There are Certain expenses which are to be actually paid to claim deduction.

Last date for payment for these is the ITR Filing due date(31 July /30 September)

If these are actually paid after that date,then deduction allowed next year when payment actually made.

Details of such expenses are

1. Any tax/duty/cess to be paid to government

2. Contribution to PF/Super Annuation/Gratuity fund

3. Bonus or Commission paid to Employees: -Refer 36(1)(ii)

If declared and not paid then not allowed as deduction

4 Interest on loan taken from Scheduled Banks/Public Financial Instituitions/State financial Corporation/State Industrial Investment Corporation etc allowed only on payment.

5, Any leave salary/leave encashment paid to employees

Q 1

| Proft and Loss of Ajay & Co,a proprietorship for FY 2015-16 | |

| SALES | 800000 |

| Less | |

| EXPENSES | 500000 |

| PROFIT | 300000 |

Suppose Expenses Include

Interest on loan of 100000 taken from bank which was paid as follows

| Date | Amount |

| 20-Feb-16 | 30000 |

| 30-Jun-16 | 50000 |

| 04-Aug-16 | 20000 |

| Total | 100000 |

Due date of ITR is 31 July 2016 but assessee filed ITR on 05-Aug-16 after paying interest

View Answer| Computation of PGBP Income | |

| Profit as per P& L A/c | 300000 |

| Add | |

| Expense Disallowed | |

| Interest on loan not paid till ITR Filing Date (31 July 2016) | 20000 |

| Less | |

| Expense Allowed | |

| PGBP INCOME | 320000 |

Q 2

Solve last question assuming loan was taken from friends and relative

View AnswerIn this case,expense will not be disallowed

| Computation of PGBP Income | |

| Profit as per P& L A/c | 300000 |

| Add | |

| Expense Disallowed | |

| Less | |

| Expense Allowed | |

| PGBP INCOME | 300000 |